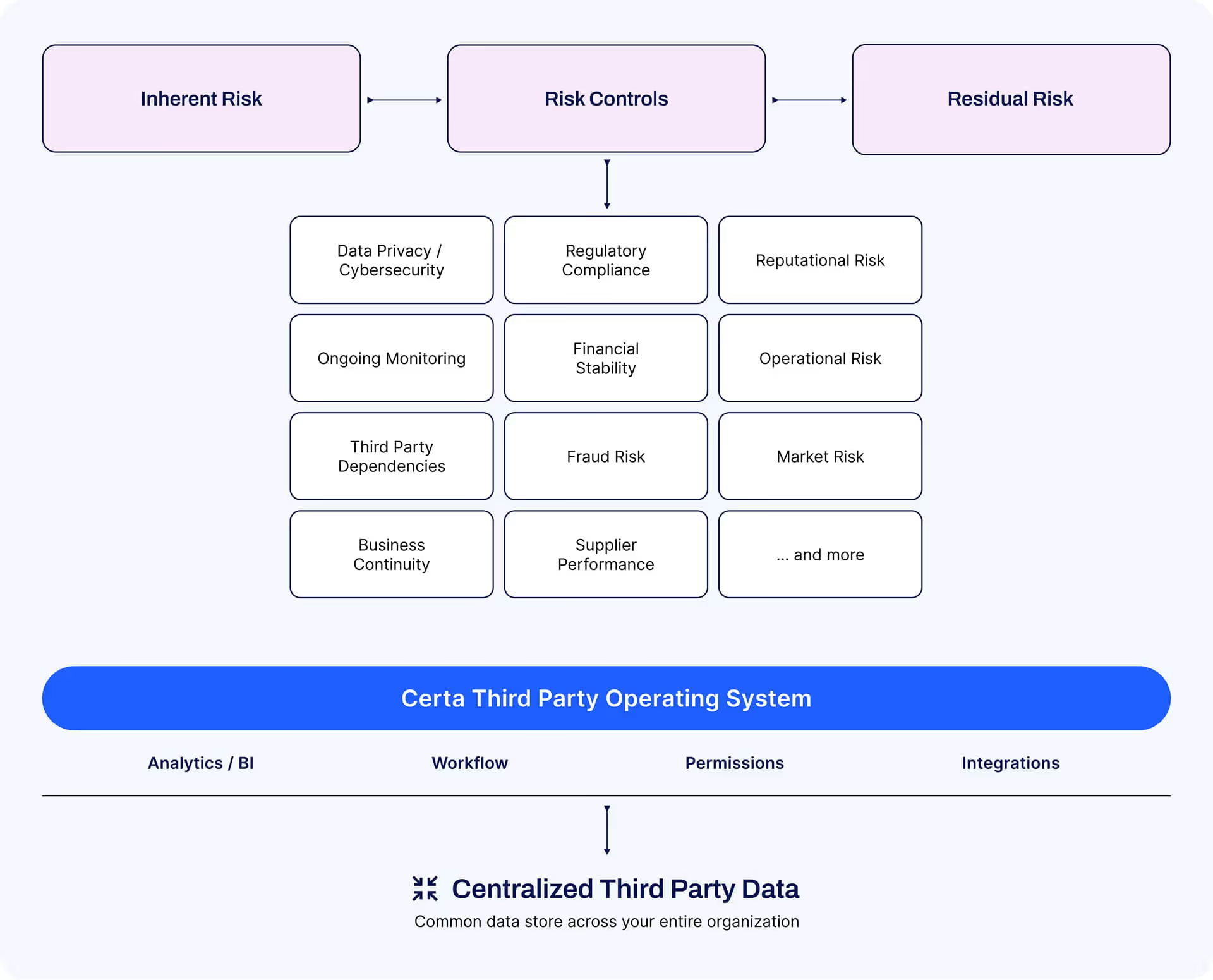

Configure Certa to your unique risk needs, whether that’s end-to-end TPRM or a specific anti-bribery check.

Mitigate regulatory risk exposure through automated onboarding for all third parties.

Automatically segment and tier third parties for a risk based approach.

Dynamically generate appropriate due diligence and related controls.

Streamline information security and privacy assessments, reducing manual work.

Ensure resilience to the most timely risks, such as cyber, cloud, and AI risk.

Maintain a thorough business continuity management program to ensure third parties deliver on time.

Mitigate regulatory risk exposure through automated onboarding for all third parties.

Automatically segment and tier third parties for a risk based approach.

Dynamically generate appropriate due diligence and related controls.

Streamline information security and privacy assessments, reducing manual work.

Ensure resilience to the most timely risks, such as cyber, cloud, and AI risk.

Maintain a thorough business continuity management program to ensure third parties deliver on time.

Guarantee that you’ll be covered even as frameworks, regulatory bodies, and internal policies change.

Implement changes quickly with the help of Design AI, which translates business requirements into workflow design.

Maintain full audit trails and documentation to easily defend with evidence.

Easily edit workflows in response to changes to internal policy or personnel.

Efficiently update frameworks and workflows - including Inherent Risk Questionnaires (IRQs) and Due Diligence Questionnaires (DDQs) - to stay aligned with constantly changing regulations and guidance.

Bolster supplier information with federated data from data brokers (e.g., BitSight, Rapid Ratings, Black Kite, Ecovadis, Panorays, Interos, and others).

Implement changes quickly with the help of Design AI, which translates business requirements into workflow design.

Maintain full audit trails and documentation to easily defend with evidence.

Easily edit workflows in response to changes to internal policy or personnel.

Efficiently update frameworks and workflows - including Inherent Risk Questionnaires (IRQs) and Due Diligence Questionnaires (DDQs) - to stay aligned with constantly changing regulations and guidance.

Bolster supplier information with federated data from data brokers (e.g., BitSight, Rapid Ratings, Black Kite, Ecovadis, Panorays, Interos, and others).

-min.avif)